Rents are Growing Faster than Wages Across the US: Why it Matters

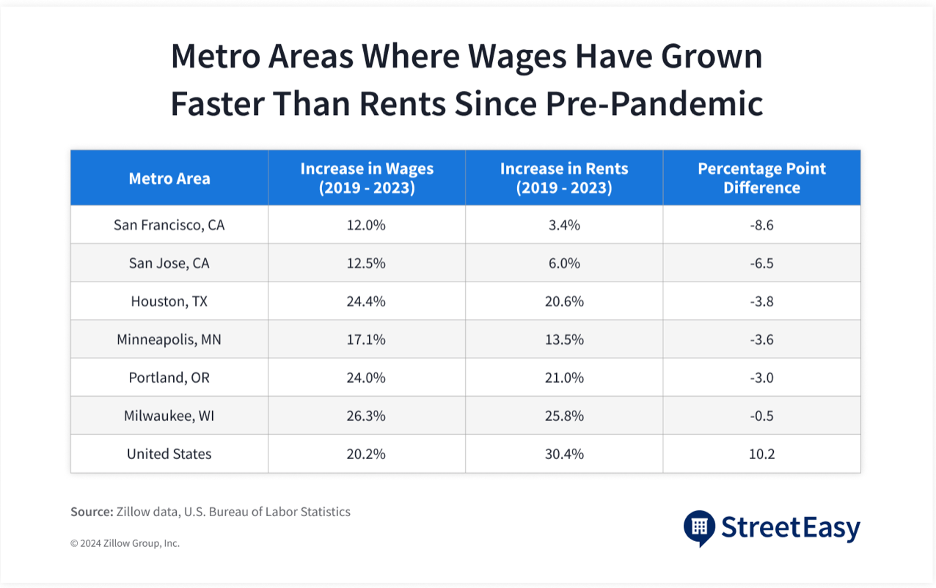

The lack of affordable housing is underscored by surging rent growth across the nation, especially in the last few years. While rent continues to climb, wages have not. In fact, rent growth has outpaced wage growth in 44 out of the 50 largest United States metros since 2020, according to data from Zillow® and StreetEasy®, as well as wage data from the U.S. Bureau of Labor Statistics. Rent has grown 1.5x faster than wages on average since 2019 and even 3x in some areas, including New York City, Boston, and Cincinatti. In New York City, wages increased by 1.2% from 2022 to 2023. However, rents surged more than seven times faster during the same period. According to a report by StreetEasy, wage growth declined in several of the country’s largest metro areas over the past year, while rent growth continued to rise.

Despite NYC’s strong job market propping up demand — and therefore prices — in the rental market, the mere 1.2% year-over-year increase in wages has not been nearly enough to counter the 8.6% increase in asking rents. Meanwhile, declining wages in the Memphis, Boston, and Chicago metro areas have made slightly more modest increases in asking rents even more challenging.

StreetEasy data also found that Tampa, Miami, and Jacksonville occupied three of the top five spots where rent growth has most dramatically outpaced wage growth since 2019-2023. During the pandemic, Florida became a hotspot due to its ideal weather and relatively affordable housing compared to many coastal markets. The increase in housing demand has led to surging rents, while wages in Florida struggle to keep up. Even Miami, where wage growth has been slightly above the national average, saw a 50% increase in rents, which is the most dramatic jump of any US market. This has left a huge gap between the income that residents are earning and the income they need to afford to live in the area.

While the lack of affordable housing is impacting residents across the country, cities like San Francisco, Portland, and Austin have seen a slight decline in rent prices as the market stabilized in 2022. Meanwhile, wage growth in these areas continued to climb.

Houston experienced the greatest annual wage growth of any metro area, nearly double the national average. It was one of only four markets where wages consistently outpaced rents both year-over-year and since before the pandemic. This wage growth, coupled with strong job gains, helped the Houston metro area rank second in the nation for population growth in 2023, according to U.S. Census Bureau data.

Investors should pay close attention to cities where rent growth is outpacing wage growth for several key reasons. First, such trends indicate strong demand for rental properties, which can lead to higher rental income and potentially greater returns on investment. Additionally, these cities often attract a transient workforce and young professionals who prioritize renting over homeownership, ensuring a steady stream of tenants. However, it’s also important to consider the sustainability of these markets, as excessive rent increases without corresponding wage growth could lead to affordability issues and higher tenant turnover. By carefully analyzing these dynamics, investors can make more informed decisions and strategically position their portfolios to capitalize on favorable rental markets.